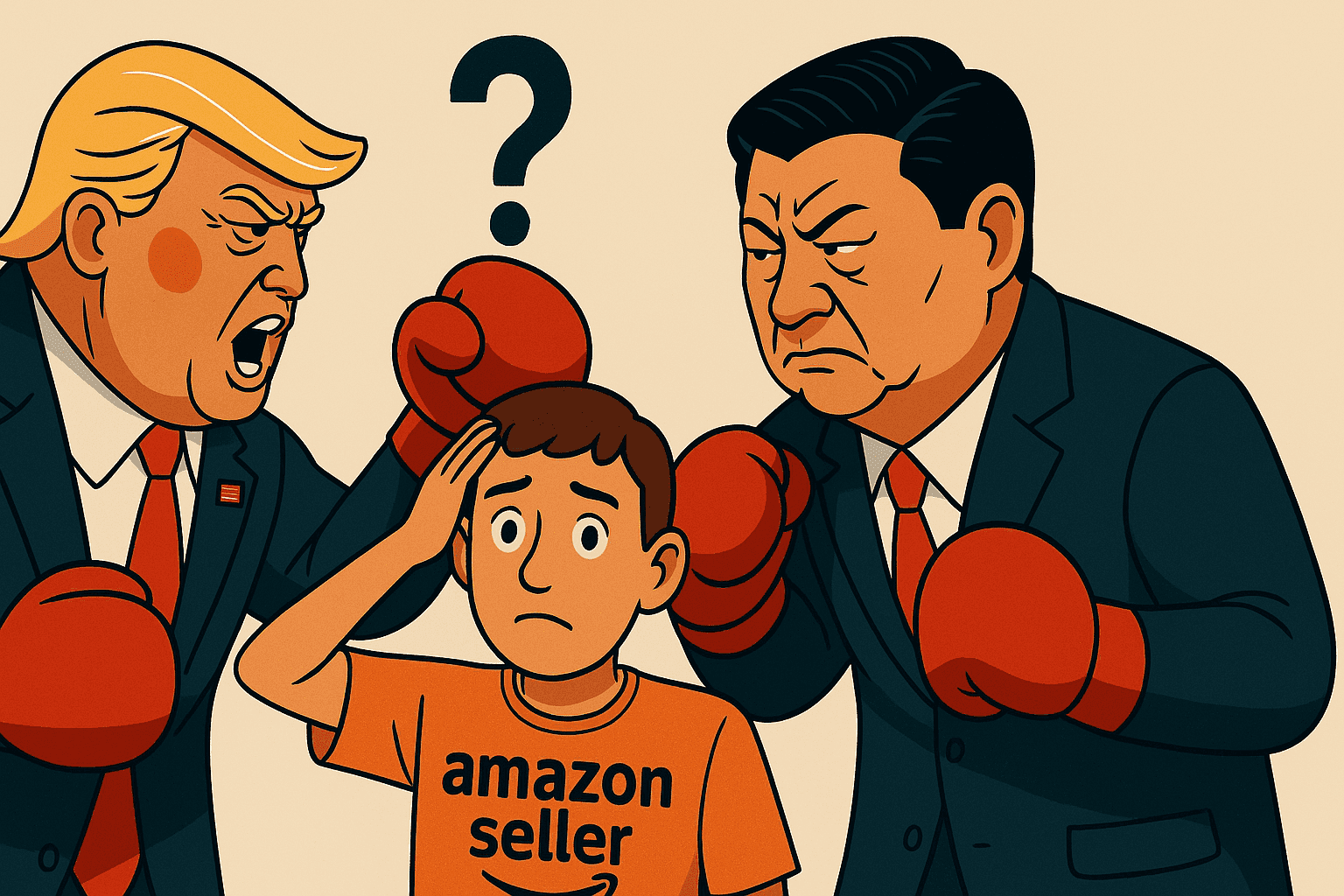

US Tariffs on China – Key Updates & What Amazon Sellers Should Do

US Tariffs on China – Key Updates & What Amazon Sellers Should Do

U.S. Tariff Escalation on Chinese Imports (Feb–Apr 2025)

- February 1: The U.S. imposed a 10% tariff on all Chinese imports, citing trade imbalances and intellectual property concerns.

- March 4: An additional 10% tariff was applied, bringing the total to 20%.

- April 2: A reciprocal 34% tariff was introduced, raising the cumulative rate to 54%.

- April 9: A further 50% tariff was added, resulting in a total tariff of 104% on Chinese goods — and later increased to 125% the same day.

China’s Tariff Response on U.S. Goods (Feb–Apr 2025)

- February 10: Imposed a 15% tariff on U.S. coal and LNG, and 10% on crude oil, autos, and machinery.

- March 10: Added 15% tariffs on U.S. chicken, wheat, corn, and cotton, and 10% on soybeans, pork, beef, dairy, and fresh produce.

- April 8: Raised total tariffs to 84% on a broad range of U.S. goods and introduced restrictions on multiple American firms.

The escalating trade war has triggered significant disruptions in the global supply chain, prompting widespread concern among Amazon sellers.

But rather than reacting with panic, this is a time to assess calmly, adapt strategically, and make data-driven decisions to maintain profitability.

What Amazon Sellers Need to Do

In the face of rising tariffs and growing uncertainty, here are five critical steps Amazon sellers should take:

1. Avoid Sudden Price Increases on Amazon

The inventory currently stored at Amazon was most likely imported before the recent tariff hikes. Increasing prices too quickly can negatively impact your Best Seller Rank (BSR) and sales momentum. Be strategic — monitor the market before making any pricing adjustments.

2. Lower Your Cost of Goods Sold (COGS)

Negotiate better product pricing for upcoming purchase orders. Explore various shipping options to secure the lowest possible freight costs. Reducing COGS is the most effective way to absorb the added tariff burden while keeping your listings competitive.

3. Review Duty Rates & HS Codes

Work with your customs broker or freight forwarder to ensure your products are classified under the most favorable HS codes. A small change in classification can significantly reduce import duties.

4. Ship to West Coast FCs or AWD Warehouses

Targeting Amazon Fulfillment Centers (FCs) or Amazon Warehousing & Distribution (AWD) facilities on the West Coast can lower inland freight charges for goods arriving from Asia, helping reduce your overall landed cost.

5. Recalculate Profitability with Updated COGS

Compare your revised landed cost (post-tariffs) with your previous COGS. In many cases, smart supplier negotiations and optimized shipping can keep margins healthy or at least offset a portion of the additional costs.

Need Help Navigating the Tariff Impact?

If you're feeling the pressure from rising tariffs, A2Z Supply Chain is here to help.

Whether it's reducing freight costs, negotiating supplier pricing, optimizing HS code classifications, or running the numbers on your updated COGS — we’re ready to support Amazon sellers through these challenging times.

📞 Book a call with us today, and let’s build a plan to protect your profitability and keep your operations running smoothly.

🔔 Stay Informed

The trade war landscape is shifting rapidly. Staying updated is essential to making smart, timely business decisions.

📲 Follow the A2Z Supply Chain WhatsApp Channel for real-time insights:

https://whatsapp.com/channel/0029Vb5fz7FDTkK25T8Cns1r